Last July, the spiritual successor to 2011’s apocryphal debt-ceiling crisis went into effect. In the name of reducing national debt, the student loans provisions of the Budget Control Act eliminated the in-school interest subsidy on Stafford loans for graduate students, effectively raising their interest rates from 3.4 to 6.8 percent.

This year undergraduate Stafford loans will suffer the same fate, unless the federal government does something immediately (ha). Beginning on July 1, new undergraduate borrowers will be expected to pay 6.8 percent interest on their Stafford loans. For most of the 35 percent of U.S. undergraduates who have Stafford loans, that translates to an additional $1,000 a year in interest—which, in my opinion, constitutes a far greater burden.

Not only is this move unfair to students, but it’s also incredibly harmful to our fragile but recovering national economy. Even worse, it’s completely unnecessary. In 2013 alone, the federal government is expected to make some $51 billion on student loan payback, or about $0.36 profit on every dollar it lends students. In the words of Massachusetts Senator Elizabeth Warren, that’s “more than the annual profit of any Fortune 500 company, and about five times Google’s yearly earnings.”

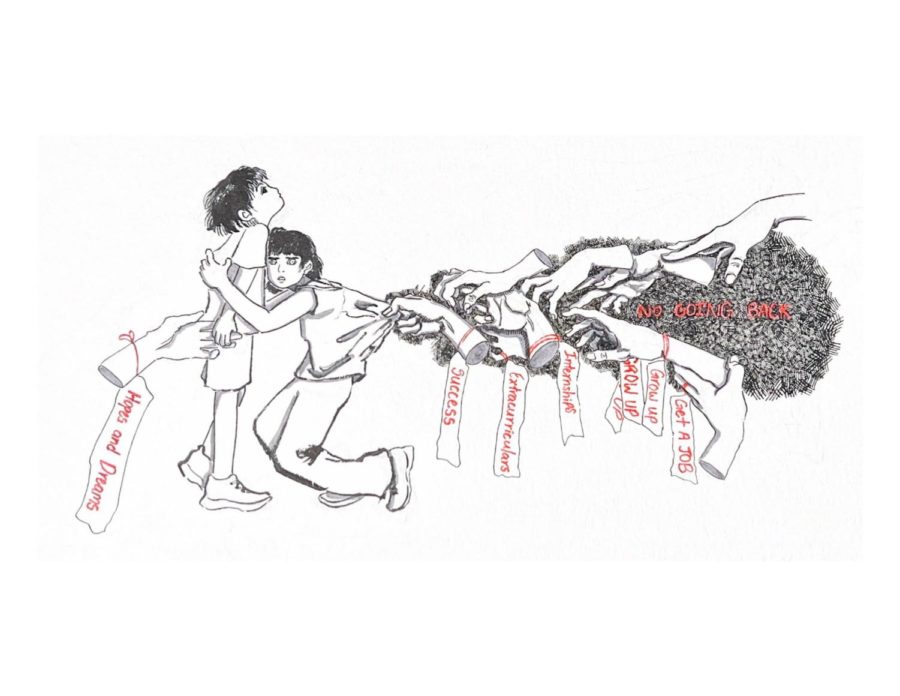

But rising student loan interest rates are only the latest financial hardship to plague U.S. college students. Since 1980, college costs octupled to more than $1 trillion, growing faster than even health care and living costs, which have respectively quadrupled and doubled in the same period. From yearly tuition hikes at more than twice the rate of inflation to several-hundred-dollar textbooks and completely unjustified administrative fees, today’s colleges are sending off graduates with an average of $25,000 in debt that even bankruptcy can’t discharge.

These figures point to a very troubling trend: a national neglect of education made all the more problematic by the necessity of higher-level education in our increasingly integrated knowledge economy. Instead of seeing education as an investment in our collective future, our Congress has come to see student loans as just another source of revenue—so much so that, today, you’d be in a much better position to borrow money from the U.S. government if you were to die and reincarnate as, say, a bank.

Needless to say, the greater economic consequences of this are disastrous. We’re the only developed country to see the current generation receive less schooling than its parents’. Once leading the world in percentage of college graduates, we’re now 12th among 36 developed nations. And though nearly 70 percent of our high school graduates do enroll in college within two years of graduating, only half of those students graduate within six years. And the graduation rate is only half that for those pursuing a two-year associate’s degree. Especially hard-hit are lower-income students, who are disproportionately more likely to drop out for financial reasons and who need our government to provide low-interest Stafford loans the most.

By all accounts, fewer of our students are graduating college—and, degree or not, nobody seems to be getting out without holes in their pockets.

Factor in a hostile job market that demands not only a degree but also experience, and the phenomenon of unpaid internships as the increasingly quintessential gateway to getting that experience, and it’s no surprise that, instead of giving an educated, energetic young workforce a head start on its professional pursuits, college is simply sending throngs of twenty-somethings back to their parents’ basements.

It wasn’t always this way. In fact, it was arguably our nation’s brilliant decision to pay the tuitions and living expenses of all World War II veterans wishing to pursue postsecondary, secondary, or vocational schooling—in the form of the 1944 G.I. Bill—that sparked rapid economic growth throughout the 1950s and made us a world leader in human capital.

And it’s not this way in other countries. Our more educated German, French, Finnish, and Danish competitors (who also happen to be making more money and report a higher level of happiness with their lives) have made public college education completely free. We could follow suit; it would only cost us about $30 billion per year—0.078 percent of 2013’s federal budget—and would virtually eliminate the financial constraints that currently inhibit so many lower-income students from completing their degrees. Such a measure could moreover check the rise of private college costs, helping make every college graduate an immediately productive member of society.

In an era when practically every job requires a college education, we should be doing even more to prepare our next generation for the market’s obvious demands. We should be actively identifying legal and economic ways to curb the rise of college tuition, and should be cultivating a national culture of college attendance and completion.

And, needless to say, we should not be raising the interest rate on Stafford loans.

Anastasia Golovashkina is a second-year in the College majoring in economics.